ohio sales tax exemption form contractor

As the consumer the contractor is re sponsible for paying sales or use tax on the purchase of the tangible personal property to be installed. Enpacadoras de paja de pino.

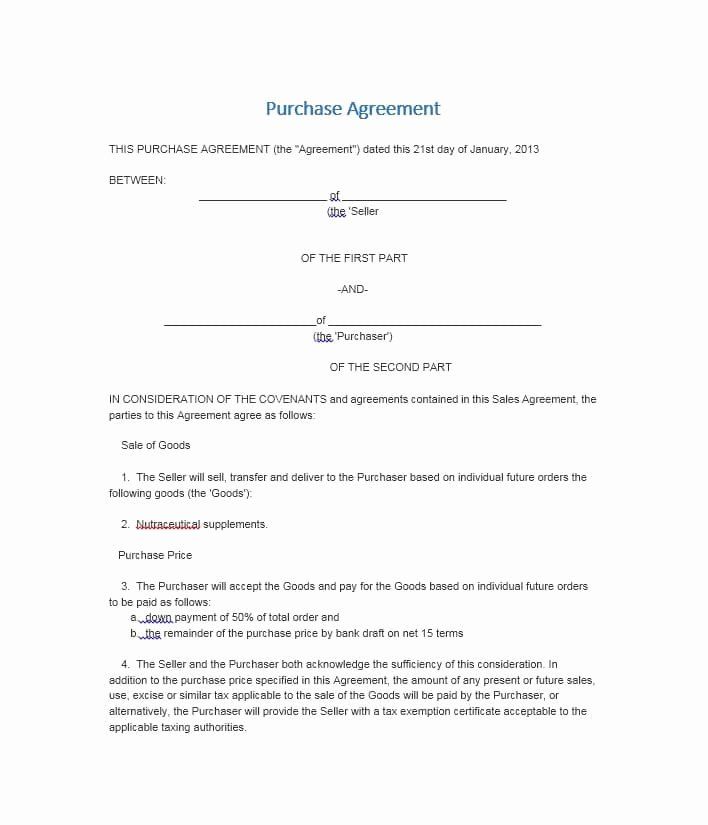

Contract Signature Page Template New Sample Fit Contract Page 5 Signature Template Haydenmedia Templates Proposal Templates Business Proposal Template

Ad Download or Email OH DTE 100EX More Fillable Forms Register and Subscribe Now.

. E A construction contractor who also makes substantial sales of the same types. For other Ohio sales tax exemption certificates go here. They do however pay sales tax on the supplies they purchase.

Real property under an exempt construction contract. A computer data center entitled to exemption under RC. If a contractor does not pay Ohio sales tax on the tangible personal property to its supplier then it generally owes.

Exempted by Ohio Revised Code Section 573902 B-1 Ohio Department of Transportation 1980 West Broad Street Columbus OH 43223 State Government CFO 182021 TIN 311334820. Real property outside this state if such materials and services when sold to a construction contractor in the state in which the real property is located for incorpora-tion into real property in that state would be exempt from a tax on sales levied by that state. A building under a construction contract with an organi-zation exempt from taxation under section 501c3 of the Internal Revenue Code of 1986 when the building is to be used exclusively for the organizations exempt purposes.

Ohio Contractors Exemption Certicate A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Ohio sales tax. Generally a contractor does not collect sales tax from their customer on the performance of a real property construction contract. Current through all regulations passed and filed through May 6 2022.

A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. The vendor must maintain the certificate to document the reason tax was not charged. A hospital facility entitled to exemption under RC.

Section 5703-9-14 - Sales and use tax. Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. With either rule 5703-9-10 or 5703-9-25 of the Admin- istrative CodeThis certificate cannot be used by construction contractors to purchase material for.

This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or services in the event the tax commissioner ascertains that the contractee was not entitled to exemption. Exemption certificatesAA construction contract is any agreement written or oral pursuant to which tangible personal property is or is to be transferred and incorporated into real property as.

How to use sales tax exemption certificates in Ohio. The contractor should obtain a Sales and Use Tax Construction Contract Exemption Certificate Form STEC CC from the customer property owner. Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of.

Ad Download or Email Form 8843 More Fillable Forms Register and Subscribe Now. A certificate covers all sales of materials made by the vendor to a contractor or subcontractor for incorporation into real property under that construction contract. Construction contractors must comply with rule 5703-9-14 of the Administrative Code.

These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock. Sales and Use Tax Blanket Exemption Certificate. 31504 Sales and Use Tax Blanket Exemption Certificate.

This form is updated annually and includes the most recent changes to the tax code. Ad Register and Subscribe Now to work on your OH STEC CC Form more fillable forms. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Available on the Ohio Department of Taxations website is the form STEC CC which is the construction contract. The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category. The contractor may purchase the tangible personal property exempt from sales tax in this situation as a sale for resale.

Construction contractors must comply with rule 5703-9-14 of the Administrative Code. You can download a PDF of the Ohio Contractors Exemption Certicate Form STEC-CO on this page. Then the contractor should provide Sales and Use Tax Contractors Exemption certificates Form STEC CO to its suppliers.

A computer data center entitled to exemption under RC. Ohio law provides that contractors are consumers of the tangible personal property that they install into real property. Construction contractors must comply with rule 5703-9-14 of the.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax. For real property jobs the contractor is considered the consumer of the materials installed and must pay sales or use tax at the time the materials are purchased. Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract.

Sales Tax in Construction. Sales and use tax. Contractors and home remodelers do not collect sales tax on their work.

Ad Mini Round Baler for Pine Straw.

Business Sale Contract Template Luxury 37 Simple Purchase Agreement Templates Real Estate Business Contract Template Purchase Agreement Purchase Contract

This Nonprofit Donation Receipt Template Helps You Create Donation Receipts For Your Organization Quickly And Ea Donation Letter Receipt Template Donation Form

Image Copyright Thinkstock Image Caption Pinterest

W12 Form Walmart Employee Ten Doubts About W112 Form Walmart Employee You Should Clarify W2 Forms Tax Forms Filing Taxes

Template Caremark Prior Authorization Form Prior Authorization Business Template Being A Landlord

Image Copyright Thinkstock Image Caption Pinterest

Image Copyright Thinkstock Image Caption Pinterest

Image Copyright Thinkstock Image Caption Pinterest

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Tax Forms 1099 Tax Form Irs Forms

Wigs By Mona Lisa Dora By Mona Lisa Human Hair Wigs 100 Human Hair Wigs Wigs

Image Copyright Thinkstock Image Caption Pinterest

Printable Excel Construction Schedule Template Schedule Template Business Template Templates

How To Declare Taxes As An Independent Consultant Sapling Jamberry Business Lularoe Business Thirty One Business

W12 Form Walmart Employee Ten Doubts About W112 Form Walmart Employee You Should Clarify W2 Forms Tax Forms Filing Taxes

Illinois Quit Claim Deed Form Quites Illinois The Deed

Image Copyright Thinkstock Image Caption Pinterest

Modern Townhouse Townhouse Designs Hostels Design

This Is Why You Can T Stop Farting Before Your Period Painful Gas Bad Period Cramps Period

Plexiglass Desk Safety Shield With Cutout Grades 4 Set Of 4 Classroom Desk Students Safety Diy Classroom